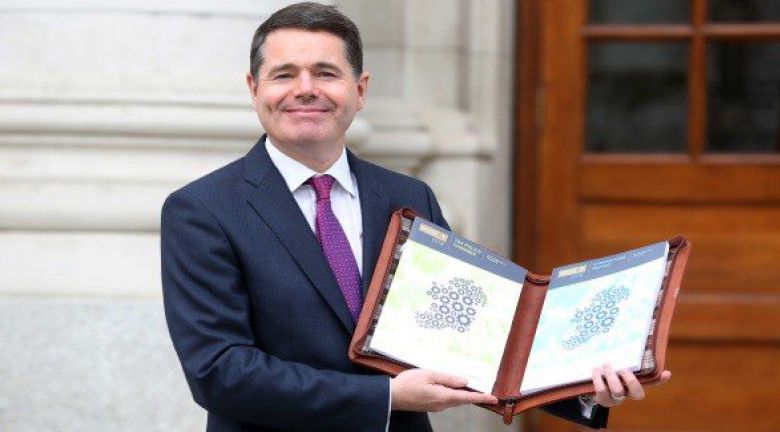

Many if not all of the budgetary measures introduced by Minister for Finance Pascal Donohoe had been flagged weeks, and in some cases months in advance. For a Professional Contractor, the news is better than for most of the population. The self-employed earned income credit will be the increased by €200 per year to €1,350 and this brings it ever closer to the PAYE tax credit as promised in earlier budgets. Changes to USC will also bring about small gains and the Tax Band has been increased by €750 to €35,300. Combined, these gains will be approximately €500 for a salary of €75k. More interesting, a jobseekers scheme will be introduced for the self-employed. At the moment it seems this sector have escaped a PRSI increase, though the full detail of this will only been seen in the welfare and finance bills. My thoughts on this would be that it has to be paid from social welfare fund in some way and the obvious mechanism is an increase of the PRSI percentage. Benefit in Kind (BIK) on Electric Vehicles has also been exempted for 3 years, with a cap of €50k on the Original Market Value (OMV) of the car, so this rules out the purchase of a Tesla! It's still a fantastic way to purchase a car if your are self-employed with your own company. This was a safe budget, with the vast majority of those hit with a tax increase being unable to cast a vote… tourists! In the words of Benjamin Franklin “a small leak will sink a great ship” – If Budget 2019 was anything to go by, I think we could be in for an election sooner rather than later! John Bell (FCCA), Finance Director

Got a Question?

Let us help

-

Icon Accounting, Columba House, Airside,

Swords, Co. Dublin, Ireland, K67 R2Y9